Buying Survey Respondents: A Comprehensive Guide

Are you interested in buying respondents for your survey but not sure where to start? In this guide, we explore the key factors that’ll lead you in the right direction when it comes to purchasing survey participants.

The following considerations are important to keep in mind:

- Survey Duration

- Survey Complexity

- Selection Criteria of Your Target Audience

- Your Experience with Research

- Data Quality and Fraud Prevention

First things first

Before purchasing survey responses, it's crucial that your survey is both correctly set up and ethically sound. Begin by reviewing questions for clarity, eliminating ambiguity, and avoiding prejudice. Then, ensure your survey is ethically set up. Is everything in order? Great! Now, consider the following before buying survey respondents:

1. Survey Duration

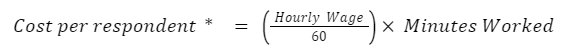

The length of your survey directly impacts the cost thereof. The longer your survey takes to answer, the more you’ll have to pay per respondent. Survey participants typically get paid based on a minimum wage, and then per minute it takes them to complete your survey. For instance, a 20-minute survey at a $15/hour minimum wage would cost $6.25 per respondent if a 25% service fee is included. The following formula can be used to calculate the cost per survey participant:

*Remember to include the relevant service fee

Beyond cost considerations, keeping your survey’s duration between 3 - 10 minutes is crucial for keeping participants engaged. Do you have a longer survey? Then it might be necessary to add attention checks so as to ensure data quality and attentiveness.

Take-away: If you're on a budget, it's advisable to keep your survey short and concise. This will also ensure that participants remain attentive when answering questions, leading to higher data quality.

2. Survey Complexity

How easy it is to complete your survey also determines how much you’ll have to pay for it to be answered. Does your survey require respondents to sign up using their email, follow-up after a certain time-period, or watch a 10-minute video? Perhaps it asks participants to provide personal information. This all adds to your survey’s complexity, doubling or even tripling the price you pay per response. In addition to this, it’s important to keep in mind that online panels favor simplicity. Can your survey be done in one session? Great. Is it possible for participants to take your survey on their mobile devices? Even better. The more straightforward your survey is, the more likely online audiences are to take part in it.

Pro-Tip: If you’re interested in a respondent’s personal identifiable info, like their email address, make it an optional question and only leave it until the end of the survey. Asking for personal information at the very start of your survey might lead to participants leaving your survey before they’ve even started.

Take-away: Be mindful of these complexities and their potential impact on your budget. Keep your survey simple to make it more suitable for online survey panels.

3. Selection Criteria of Your Target Audience

Paid survey panels often have limited databases of available survey-takers, ranging from hundreds of thousands to millions of possible participants. While this might seem like a lot, it’s important to keep in mind that not all of these panel members will qualify to take your survey. Not only this, but certain types of people aren’t in the business of taking online surveys to earn an income. Is your survey open to a diverse group of participants – people from all ages and genders, from all over the world, for example? Then you probably won’t have any issues finding respondents and won’t have to pay them exorbitant prices to take your survey. The more specific or niche your target audience gets, however, the smaller your pool of participants becomes. This will also drive up your cost per response.

So, what does a hard-to-reach, niche sample look like?

- High-level Professionals, for example:

- CEOs

- Doctors

- Lawyers

- Real Estate Investors, etc.

- Specific demographics, for example:

- German-speaking mothers of toddlers living in the Netherlands

- Pet-owners between the ages of 21 and 23 from Orange County, USA

- Middle-aged digital nomads who have traveled to 3 countries in the past year, etc.

- Rare combinations of the above, for example:

- Female CEOs of Fortune500 companies

Picture this: You're a high-level professional overseeing a multinational enterprise. Now, consider the likelihood of such an individual taking the time to complete an online survey for little to no compensation – odds are slim, right? Apply a similar thought process to assess how easy it’ll be to reach your target group. Ask yourself: "What is the size of my potential participant pool, and how probable is it that they would dedicate time to participate in an online survey?” The answer should guide you to tailor your approach to engage your audience more effectively.

Take-away: If your sample is very niche, consider alternative sampling methods that don’t necessarily involve buying your survey respondents. Where possible, keep your target audience as simple as possible.

4. Your Experience with Research

If you're new to purchasing survey respondents or lack confidence in your research abilities, it can be quite challenging to gather survey respondents, whether you pay for them or not. The landscape of online research can also be very complex and, in some cases, may require a consultant who has run thousands of survey projects to know what works and what doesn’t. In this case, paying a bit extra to have someone take your hand can be very reassuring and even save you a lot of time and money – not to speak of headaches!

Take-away: Consider approaching providers that offer personal assistance with data collection. Experienced researchers can guide you on best practices, quality control questions, survey formatting, and software selection in a way that’s tailored to your audience.

5. Data Quality and Fraud Prevention

The unfortunate truth is that almost all survey panels are full of respondent click farms – illegal, professional scam organizations that are armed with fake accounts and IP-addresses, who pretend to be “regular people” who fit within your sample criteria. This poses a real threat to your data quality.

So, how should you work around this? Start by implementing “traps” or attention checks in your survey to filter out such respondents. Attention checks are like little tasks that ensure respondents are actively engaged and provide thoughtful responses. For example, include a question stating "Please select 'Agree' for this item" in a series of statements where respondents typically choose their level of agreement. Failure to follow the instruction signals a lack of attention to detail, which could mean the participant’s answers are insincere. Setting up checks like these in your survey is essential in identifying and being able to eliminate poor-quality data.

Pro-Tip: Look for panels that allow you to disqualify low-quality answers from your survey. Ideally, the panel should have built-in mechanisms to automatically disqualify participants who fail attention checks, or at least help you to set up those quality check questions before setting your survey live.

Take-away: To ensure data quality, always add relevant attention checks to your survey to disqualify participants who don’t fit your sample’s criteria or who don't participate in your survey truthfully – even if the panel at hand is well-known or reputable. If possible, make use of panels that automatically disqualify survey-takers who fail attention checks.

Checklist for Buying Survey Respondents Online

- Ensure your survey is set up correctly and is ethically sound

- Write a compelling title, description and survey landing page

- Evaluate the ease of reaching your target audience online

- Consider consulting a research expert for very niche groups

- Keep your survey as short and concise as possible

- Research reputable panel providers by checking online reviews and assessing their transparency on data quality and fraud prevention.

- Implement disqualifiers and attention checks to filter out poor-quality data

FAQ

1. What influences the cost per response in paid survey panels?

The cost per response is primarily influenced by survey duration, survey complexity, and your specific selection criteria. Longer and more complex surveys, as well as niche audience criteria, tend to increase the cost per response.

2. What is “incidence rate” and why does it matter when buying respondents?

Incidence rate refers to the percentage of individuals in a population that fit your survey’s criteria. It matters because it helps you to gauge how easy it’ll be to reach your target audience. Higher incidence rates make it easier and more cost-effective to find suitable respondents, since there are more individuals in a population that qualify to take your survey.

3. Can I buy respondents for niche sample groups?

Yes, you can buy respondents for niche sample groups, but it can prove to be challenging. The more specific your target audience is, the smaller your pool of potential participants will be, leading to higher costs per response. Consider alternative sampling methods if you’re targeting a very niche sample group, or get help from consultants or other experts in the field of research.

4. How can I ensure data quality when using paid survey panels?

To ensure data quality, implement attention checks in your survey to filter out poor-quality responses. Look for panels that automatically disqualify participants who fail attention checks.

5. What does it cost to buy survey respondents?

The cost per respondent will vary depending on the panel provider you’re using. In general, you can calculate the cost per respondent by multiplying the respondent’s rate with the time it’ll take them to complete your survey. Remember to factor in the service fee when setting up your survey’s budget.

6. How do I know if a survey panel provider is trustworthy?

Trustworthy survey panel providers are transparent about their recruitment practices, data quality measures, and fraud prevention strategies. Reputable providers also prioritize participant confidentiality and adhere to ethical standards. Always look for reviews, testimonials, or references from other researchers before choosing a paid survey panel provider.

7. Can I use incentives to improve survey participation?

Yes, using incentives like monetary rewards or gift cards can significantly improve your survey’s response rate. However, ensure that the incentives are fair and proportional to the effort required to complete your survey. Be mindful of ethical considerations before offering incentives to maintain the integrity of your data.

P.S. We’re passionate about research, which is why we’ve made it possible for you to buy survey respondents that are of high quality – no click farms, no fake responses; just real data from real people.